All Categories

Featured

Table of Contents

A PUAR permits you to "overfund" your insurance coverage policy right up to line of it ending up being a Modified Endowment Contract (MEC). When you utilize a PUAR, you quickly increase your cash money value (and your death advantage), therefore boosting the power of your "financial institution". Even more, the more money value you have, the greater your interest and dividend repayments from your insurer will be.

With the surge of TikTok as an information-sharing platform, financial advice and strategies have actually discovered an unique method of spreading. One such method that has been making the rounds is the boundless banking idea, or IBC for short, amassing recommendations from celebs like rapper Waka Flocka Flame. While the technique is presently prominent, its roots map back to the 1980s when economist Nelson Nash presented it to the globe.

What are the risks of using Infinite Banking Retirement Strategy?

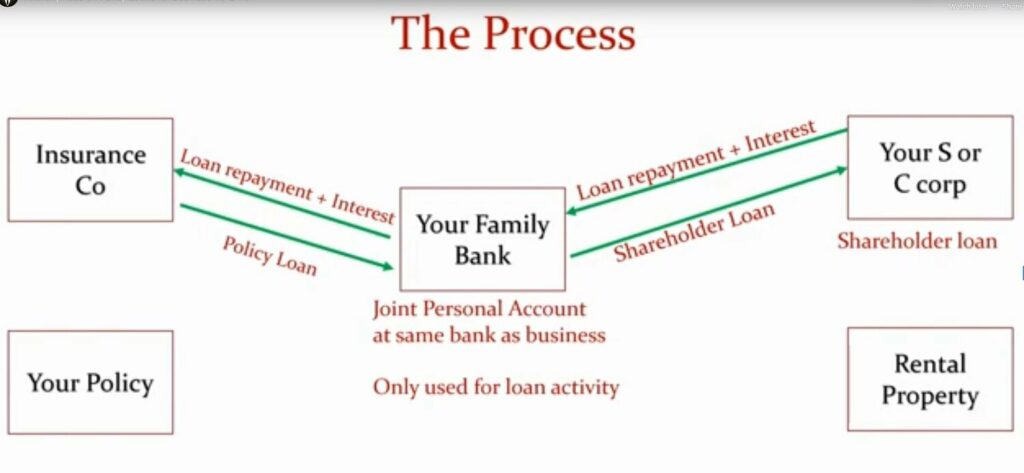

Within these policies, the cash worth grows based upon a rate set by the insurer (Self-financing with life insurance). As soon as a substantial cash value collects, policyholders can acquire a cash money value finance. These fundings differ from standard ones, with life insurance policy serving as security, suggesting one might shed their protection if loaning excessively without appropriate cash money worth to support the insurance coverage costs

And while the appeal of these plans appears, there are natural restrictions and dangers, necessitating diligent cash money value monitoring. The technique's legitimacy isn't black and white. For high-net-worth people or local business owner, particularly those making use of approaches like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and compound development might be appealing.

The attraction of infinite financial doesn't negate its obstacles: Price: The fundamental demand, a permanent life insurance coverage plan, is more expensive than its term equivalents. Qualification: Not everybody qualifies for entire life insurance policy due to strenuous underwriting processes that can leave out those with certain health or way of life problems. Complexity and risk: The complex nature of IBC, coupled with its risks, may hinder many, especially when easier and much less high-risk options are readily available.

Is Financial Independence Through Infinite Banking a better option than saving accounts?

Alloting around 10% of your monthly income to the policy is just not practical for a lot of people. Component of what you check out below is just a reiteration of what has already been stated above.

So before you obtain right into a situation you're not gotten ready for, recognize the adhering to initially: Although the principle is typically offered thus, you're not actually taking a loan from on your own. If that held true, you would not need to settle it. Instead, you're borrowing from the insurance provider and need to settle it with passion.

Some social media articles recommend making use of money worth from entire life insurance policy to pay down credit score card debt. When you pay back the financing, a section of that interest goes to the insurance coverage firm.

For the initial a number of years, you'll be paying off the compensation. This makes it extremely challenging for your plan to collect value throughout this time. Entire life insurance policy expenses 5 to 15 times a lot more than term insurance policy. Lots of people simply can not afford it. Unless you can pay for to pay a couple of to several hundred dollars for the following decade or more, IBC won't work for you.

Can I use Policy Loan Strategy for my business finances?

If you call for life insurance policy, here are some beneficial suggestions to consider: Take into consideration term life insurance policy. Make certain to go shopping around for the best price.

Imagine never having to stress regarding bank financings or high interest prices once more. That's the power of limitless financial life insurance.

There's no collection lending term, and you have the liberty to select the repayment routine, which can be as leisurely as paying off the car loan at the time of death. Infinite Banking benefits. This versatility includes the maintenance of the lendings, where you can go with interest-only repayments, keeping the finance equilibrium flat and convenient

Holding cash in an IUL taken care of account being attributed rate of interest can commonly be much better than holding the cash on down payment at a bank.: You've always imagined opening your own pastry shop. You can borrow from your IUL plan to cover the first costs of renting a room, purchasing devices, and employing team.

What type of insurance policies work best with Policy Loans?

Personal finances can be gotten from conventional financial institutions and credit report unions. Obtaining money on a credit report card is normally really pricey with annual portion rates of rate of interest (APR) frequently getting to 20% to 30% or more a year.

Latest Posts

Infinite Banking Vs Bank On Yourself

Ibc Life Insurance

Want To Build Tax-free Wealth And Become Your Own ...